Talk to our team of experts for a live demo and learn how to drive performance and increase conversions over Q4.

With tariffs, inflationary pressures, and shifting consumer confidence weighing on spending, holiday retail sales are expected to slow compared to previous years. Despite the economic uncertainty, Black Friday is expected to outperform overall holiday ecommerce growth, with early sales events in November once again pulling consumer dollars forward and making the 2025 holiday season a make-or-break moment for marketers.

For advertisers, this means staying laser-focused on efficiency and scale, while making every channel work harder in a highly crowded and competitive deal-driven environment. For many marketers, TV plays a unique role in that mix by delivering both reach and impact to break through the noise, drive urgency, and capture wallet share when it matters most.

Thankfully, with advanced planning (and a little Tatari data science magic), we help countless marketers reach holiday shoppers with their BFCM-themed campaigns. And after analyzing the historical data for these brands, as well as taking their pulse on the state of this year's holiday season, we’ve pulled out a few common trends we typically see each year. This BFCM Playbook uncovers key lessons when it comes to TV ad inventory clearance, performance, and creative strategies you can use as you plan for the most important time of the year.

TV inventory in the remnant market operates on an auction-like bidding system. Advertisers who place higher bids for an ad slot (ie. paying at or above the rate card) will typically land higher clearance rates, with the same logic applying to those on the lower-priced end of the bidding spectrum. During time periods where the demand for inventory increases, maintaining high clearance rates can be difficult.

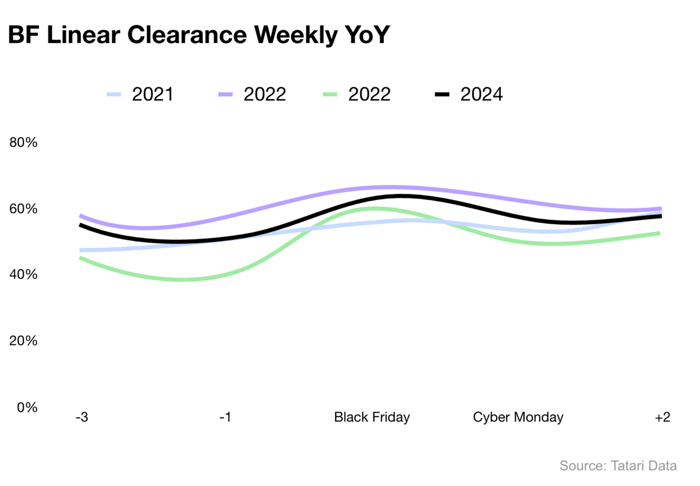

Historical clearance rates for linear and streaming TV all edge downward in the weeks prior to the holiday sales. As inventory is snatched up—oftentimes via advanced Non-preemptible (NPE) buys—the cost of the remaining inventory begins to creep upward. Brands playing in the remnant market (who did not book in advance) are forced to factor this in. If they fail to do so and in turn come up short with their bid, they will be left with lower than expected clearance rates; a critical misstep for brands looking to boost reach and awareness of a sale.

We do see clearance improve during the actual day of the sales - be it Black Friday for linear and Cyber Monday for streaming. This is likely due to inventory availability increasing as brands taper their campaigns after the sale they were advertising has concluded. So for those looking to capitalize on “day-of” BFCM advertisements, there is opportunity in the remnant space.

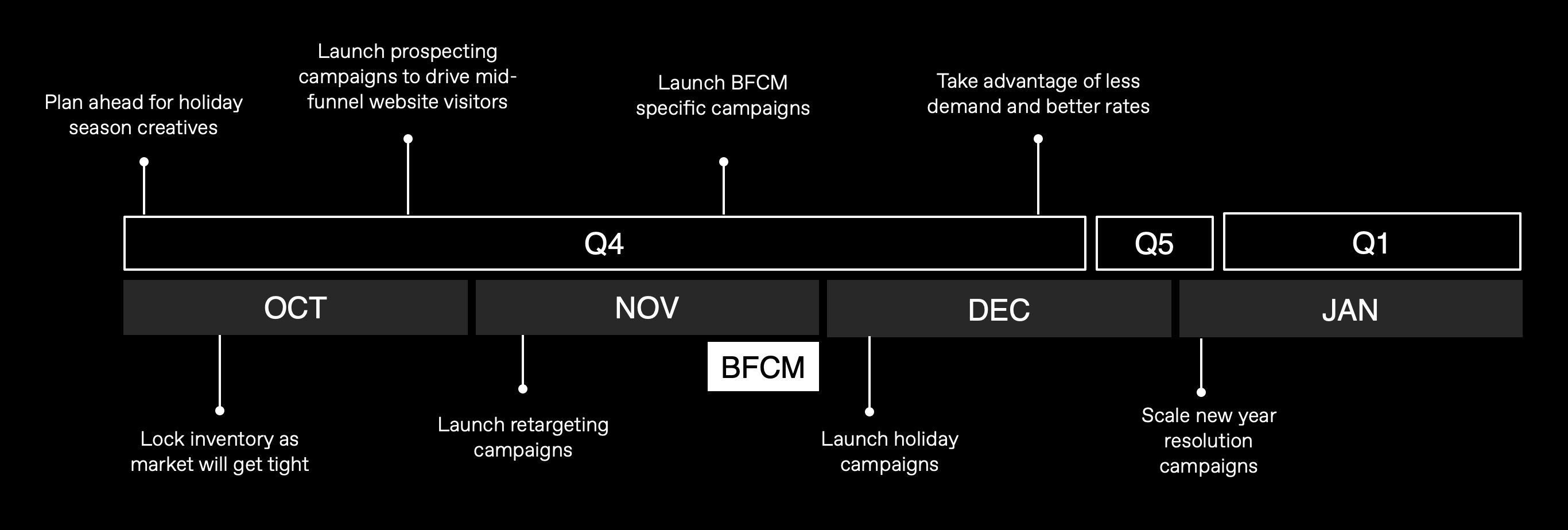

The key takeaway here is that successful brands employ more than one TV ad-buying strategy. Staying agile in the remnant market can be fruitful, but brands that place a high emphasis on clearance rates—especially in the weeks leading up to BFCM— should be booking placements several months in advance as well.

Advertisers should also strongly consider launching their TV campaigns at the beginning of Q4 to drive awareness and gather performance insights leading up to BFCM. This allows advertisers to optimize ahead of time and confidently scale going into the week of BFCM.

Did you know?

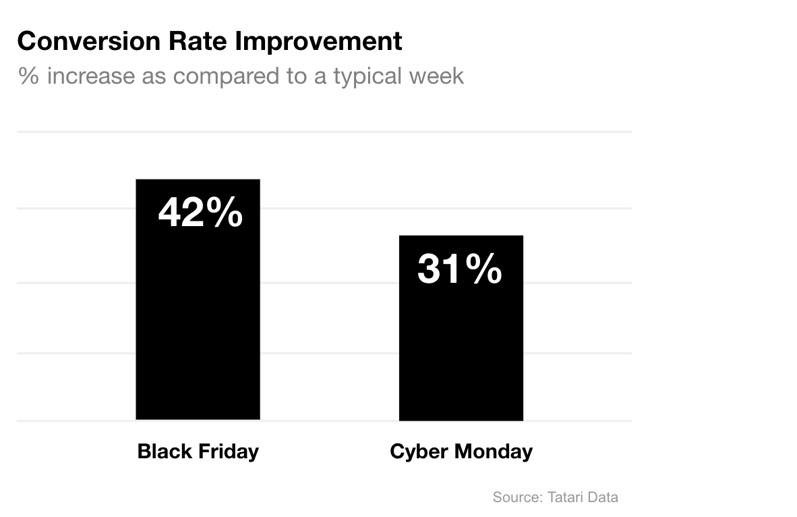

Running a BFCM campaign can be a daunting task, but brands planning a performance-focused TV campaign during this time should do so with confidence. After aggregating the last three years of data, we found that Tatari clients who run Black Friday/Cyber Monday advertisements typically see a substantial boost in conversion rates when compared to a typical week. This means that not only are valuable impressions being served to their target audience during this highly competitive time, but that the audience is significantly more likely to take action and engage!

The implications of this are that your TV budget can scale significantly while still maintaining overall efficiency. This is why premium networks, sponsorships, and NPE CPMs are more desirable (and required) during this time period.

Did you know?

Tatari has numerous clients in-market with BFCM-themed creatives every year. And while each will be promoting something different, it’s easy to spot the similarities across the board.

Take Made-in and Magic Spoon for example; both brands have utilized an end card that promotes their Black Friday deal on-screen, while also mentioning the sale via voice-over.

Or look at Knix, whose creative features a sales “sticker” that is present throughout the entirety of the ad—making it nearly impossible to miss the fact that they are hosting a Black Friday sale.

And lastly, check out how MVMT took the best of both worlds—leveraging a Black Friday sticker throughout, as well as a sale end card and VO mention.

These are just a few examples of Tatari clients looking to make a splash during the BFCM time period. And while there is no “one-size-fits-all” creative approach, it’s easy to see the tactics that many of the top brands are leveraging this holiday season.

Did you know?

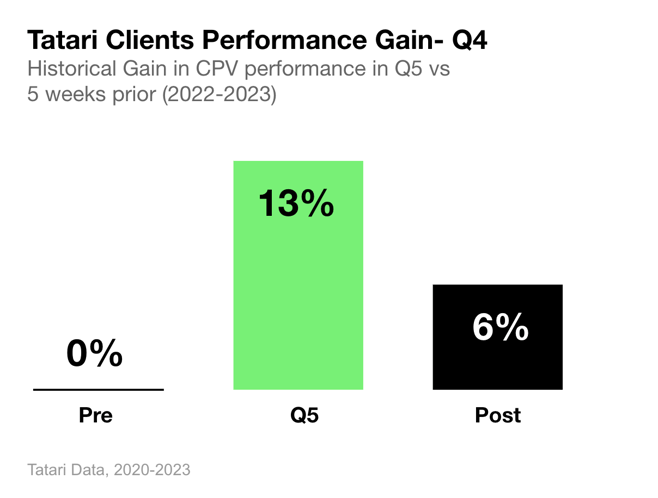

Higher conversions don't just stop after BFCM. Tatari refers to the weeks following BFCM and leading into the new year as “Q5,” and this time period traditionally brings an abundance of opportunities for ambitious TV advertisers.

Q5 starts around December 22 (when shipping deadlines have passed), but we expect to see benefits starting the week of December 18th, and into the week of Jan 1st. Many advertisers pull out of the market around the holidays, meaning an inventory surplus takes shape and steep discounts are available during this time. Tatari’s historical averages show a ~25% decrease in CPMs in Q5 compared to the rest of Q4 and Q1.

We also see that advertising performance is more efficient during this time. Historically, our clients see a ~13% increase in efficiency during Q5.

It’s time to make TV your next performance channel. Talk to our team of experts for a live demo.