FULL

FUNNEL

VISION

HOW 6 PERFORMANCE-DRIVEN BRANDS

USE TV THROUGHOUT THE MARKETING FUNNEL

FULL

FUNNEL

VISION

HOW 6 PERFORMANCE-DRIVEN BRANDS

USE TV THROUGHOUT THE MARKETING FUNNEL

Television’s pre-eminence as a brand-building channel has, at times, created the faulty perception that visibility is the only thing it can accomplish. That couldn’t be further from the truth.

The data-driven targeting and measurement tools that marketers have become accustomed to for digital campaigns have evolved to make TV—both connected and traditional linear—responsive and performance-focused. TV is still unmatched when it comes to branding. But it is now a multi-faceted, multi-use advertising channel that can be as effective at driving conversions and measurable sales as it is at generating awareness.

Of course, TV also maintains its pre-eminence as the household hearth, the place where all members gather to be entertained. Its ability to reach a highly engaged and receptive audience is well-documented.

What’s changed, and where TV’s increasingly strong addressability and measurement become more and more important, is the shopping journey that consumers now take. While the stages of the marketing funnel are still based around awareness (upper funnel), consideration (middle funnel) and purchase (lower funnel), the consumer now frequently takes a much less linear approach.

The ubiquity of mobile devices, social media and one-click ecommerce means that the journey is now more fragmented and more complicated to measure. Messages come from anywhere, research is readily available and price comparisons are just a click (or even voice command) away. This is why more and more advertisers are taking a full-funnel approach that can drive awareness and demand across a range of channels.

So, what does full-funnel TV look like?

To help you better understand the full breadth of TV’s capabilities, let’s look at how six forward-thinking disruptor brands have effectively used TV to achieve a wide range of KPIs across all stages of the marketing funnel.

Even in a performance-based, direct-to-consumer campaign, brand awareness is critical to locate new customers who might not yet know they need your product, reignite interest among lapsed customers or tempt purchasers of a rival brand. This has long been the purpose of most TV campaigns.

For example, it’s no longer necessary to blast your car ad to all the viewers of a single show on a single network. Instead, advances in audience segmentation ensure that you can reach those most likely to be receptive to learning about your latest model.

At the same time, top-of-funnel TV engagements can be done at a lower cost. Sure, there are still huge sports events and awards shows which require seven-figure budgets for 30-second spots. But there are also must-see moments that can be had for a fraction of that.

Hair growth brand Nutrafol had long relied on search and social advertising to reach consumers actively looking for hair loss solutions. While the strategy was successful, it was becoming harder to find new customers on these channels. Greater competition among direct-to-consumer brands trying to reach people on search and social was also driving up Nutrafol’s consumer acquisition costs.

As such, Nutrafol turned to TV in hopes of finding a more efficient awareness-generating channel, working with Tatari to execute measurable and hyper-targeted TV campaigns. The collaboration started with a quick pilot campaign to gain some preliminary insights, such as identifying the relative long-term value of different audience segments (Nutrafol has products for different genders and life stages).

The pilot allowed Tatari to identify when and where it could reach Nutrafol’s target audiences most efficiently, revealing specific networks and programs where Nutrafol could expect the most bang for its advertising buck. The data was so rich and granular, in fact, that it even allowed Nutrafol to identify specific dayparts when its messaging would be most effective.

The insights proved invaluable. Nutrafol was so pleased with its early results that the TV newcomer then executed several premium ad buys, such as Adele’s CBS special and Oprah’s interview of Prince Harry and Meghan Markle. Tatari’s dashboard also allowed Nutrafol to continue experimenting, buying remnant inventory at a lower rate and testing creative with new networks and audiences. Eventually, some of these new networks were incorporated into Nutrafol’s more permanent TV strategy.

There have also been significant halo effects of Nutrafol’s TV efforts. Traffic to its website spikes during its campaigns, and the TV ads have driven an increase in incremental reach and sales.

The Covid pandemic had made people more health focused and sheltering in place made them more open to virtual healthcare solutions with organizations such as Teladoc Health. Quarantine orders also created an audience of people eager for news about how to better manage their own and their family members’ health. To reach this audience, Teladoc opted to sponsor a segment on Good Morning America. The decision was a large-scale media buy for the telehealth provider, but the circumstances suggested it was worthwhile.

Plus, Teladoc had a year’s worth of Tatari data indicating that a GMA buy, based on audience demographics, was a sound investment.

The campaign was an enormous success, with all goals met or exceeded. Not only did the sponsorship achieve Teledoc’s top-line goals of increasing brand awareness and website visits, it also increased engagement and performance across Teladoc’s social and digital marketing channels. This halo effect shows TV’s broad, journey-based impact.

![]() TV is a reach machine for brands, allowing them to connect with a large number of consumers and generate widespread awareness.

TV is a reach machine for brands, allowing them to connect with a large number of consumers and generate widespread awareness.

TV advertising—with its well-documented vast reach—has historically seemed like a channel that required a blanket approach. An ad buy would be targeted by broad demographic swaths related to age and gender. The more refined targeting that the middle of the funnel requires didn’t seem possible. And while it might seem, for instance, that women 35-44 would be the ones most likely to, say, travel for a spa weekend, there was no way to know if your ads actually moved them closer to making that purchase.

Refined audience segmentation techniques make it easier for brands to find and target consumers interested in their brand and move them from the middle of the funnel to the bottom.

Each year, the Hallmark network broadcasts a slate of holiday-themed, made-for-TV romantic comedies that attract predominantly female audiences. These shows would seem a natural fit for activewear leader Fabletics, whose customer base over-indexes female. Through a partnership with Tatari, Fabletics was able to scale its TV investment in an incredibly efficient manner.

Instead of advertising during Hallmark’s holiday specials (which attract heightened viewership and thus are more expensive), Tatari data showed that Fabletics could reach the same audience in the weeks before the specials aired. Fabletics ran a TV campaign across several networks, Hallmark included, to promote its Black Friday and Cyber Week deals.

Using Tatari’s dashboard to measure performance, Fabletics optimized its pre-Black-Friday/Cyber-Monday campaign to focus on only the highest-performing TV networks, and the results were stellar. Consumer acquisition cost decreased by almost half over the life of the campaign, meaning Fabletics more efficiently converted new customers, driving up its ROAS.

The closed-loop measurement system also showed the incremental increase in reach and sales Fabletics could expect from any increase in its ad budget, allowing Fabletics to scale its ad spend up and down, as needed, while campaigns were mid-flight. There was also a strong halo effect, as web searches for the brand and direct website traffic increased amid the campaign.

Like many emerging direct-to-consumer brands, Lume initially relied solely on digital advertising for its line of natural, aluminum-free deodorants. But as the brand grew, Lume was left looking for new ways to increase consideration among consumers, while lowering its customer acquisition costs.

With Tatari’s help, Lume discovered it could increase consideration, reach a new demographic and drive sales by incorporating TV into its mix.

Lume’s first TV campaign—featuring creative from some of its top digital campaigns—was a hit from the very start, delivering surprisingly positive response from consumers. Awareness and brand perception lifted immediately. Next up was to find a way to capitalize on that success.

Using Tatari’s platform, Lume A/B tested its commercial to different market segments and discovered it should focus on more ad spend on female consumers. It also identified seasonal periods of increased demand and doubled down on its investment to capture those spikes.

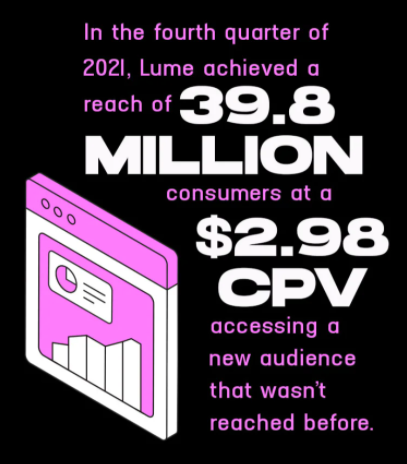

This data-driven approach helped Lume exceed its goal at all levels of the marketing funnel, achieving massive reach at a fraction of the usual costs. In the fourth quarter of 2021, Lume achieved a reach of 39.8 million consumers at a $2.98 CPV, accessing a new audience that wasn’t reached before.

The campaign was so successful that Lume has scaled up its TV investment, all while keeping its cost per acquisition at a manageable price. Now, a majority of Lume’s new customers report first hearing of the brand from its TV commercials.

![]() With the proper measurement, monitoring and optimization tools, marketers can identify the most cost-efficient TV advertising opportunities, allowing them to drive down the costs and treat TV as a mid-funnel medium.

With the proper measurement, monitoring and optimization tools, marketers can identify the most cost-efficient TV advertising opportunities, allowing them to drive down the costs and treat TV as a mid-funnel medium.

![]() Mid-funnel requires a more targeted approach, and using data to optimize campaigns for audience alignment can help ensure reaching the most qualified consumers.

Mid-funnel requires a more targeted approach, and using data to optimize campaigns for audience alignment can help ensure reaching the most qualified consumers.

Lower funnel is where the rubber meets the road. And not just if you’re selling tires. The bottom of the funnel is all about conversion, where a “buy” call to action brings shoppers closer to making a purchase. It’s not that TV allows you to click through and buy now (or at least not yet), but advanced cross-device measurement and attribution allow brands to see the impact a TV spot had on the ultimate purchase.

Clear data streams ensure that brands can have transparency into viewer behavior and ensure they are measuring what really matters to their bottom lines.

Work-from-home comfort and beyond. Leading lifestyle footwear brand OluKai wanted to drive sales for its latest product extension: plush house slippers built to roam.

Using Tatari’s creative analysis tools, OluKai tested five different creative concepts and found which ads worked better for male and female customers, as well as the effectiveness of voiceover and running on specific networks. Insights gathered allowed OluKai to optimize the campaign to drive conversions.

Optimization worked, having a significant impact on ROAS. And the brand now plans to increase its TV budget, not just in terms of total dollars but also as a share of its overall marketing spend.

Onewheel, known for its single-wheel electric skateboard, launched two new products—the Onewheel Pint X and Onewheel GT—via a live YouTube event in October 2021. And while this generated some splashy awareness for the products, Onewheel turned to a mix of linear and connected TV to move its audience to purchase.

On the linear side, Onewheel’s buys were expressly designed to boost brand/product awareness. Connected TV, on the other hand, had more specific performance-based metrics: Reach a younger audience, reach an incremental audience to the one it was reaching on linear TV, and then trigger conversions via programmatic retargeting ads.

The linear TV execution involved targeting specific sports events that aired following the YouTube event. On the streaming side, the main part of the campaign focused on an ad blitz on Hulu, targeting adults ages 18-49. The campaign also aired on other streaming publishers such as Discovery, Peacock and Paramount+.

For the second phase of the campaign, Onewheel worked with Tatari to retarget consumers on connected TV who had visited Onewheel’s website but didn’t make a purchase. The campaign reached those consumers across dozens of connected TV platforms, serving them ads for Onewheel’s new products. Ultimately, the effort stayed close to the brand’s typical efficiency goals while still scaling up and increased incremental sales—and there’s no better lower-funnel metric than sales. The streaming campaign allowed Onewheel to reach an incremental audience to linear, with 72% of the reach being exclusive to streaming.

![]() Optimization and retargeting tools have transformed TV, especially connected TV, into a highly effective channel for driving sales.

Optimization and retargeting tools have transformed TV, especially connected TV, into a highly effective channel for driving sales.

![]() TV’s increased addressability can be used for retargeting by identifying, say, people who have visited a website but not bought and using CTV ads to move them toward conversion.

TV’s increased addressability can be used for retargeting by identifying, say, people who have visited a website but not bought and using CTV ads to move them toward conversion.

Want to learn more about data-driven TV advertising? Our team is here to answer your questions!